Mastering Jenkins: What It Is, How It’s Used, and Pro Tips

Plus, more links to make you a little bit smarter today.

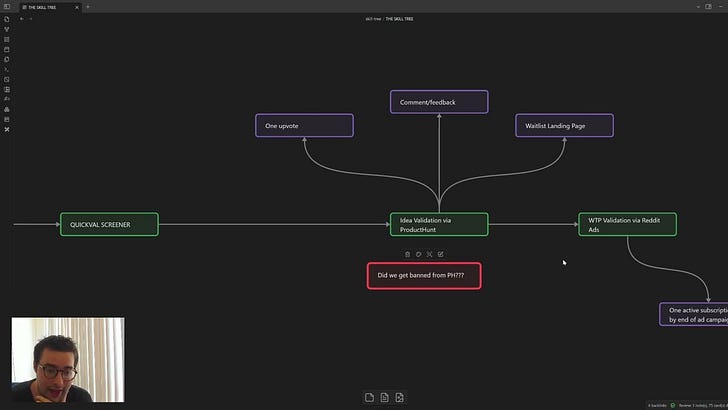

Making a new video every week until I make $5 million - Week 5

Mastering Jenkins: What It Is, How It’s Used, and Pro Tips

In modern software development speed and reliability aren’t just luxuries—they’re necessities. Continuous Integration and Continuous Delivery (CI/CD) practices have become central to shipping code faster and with fewer bugs. One of the most powerful tools in the CI/CD toolbox is Jenkins, an open-source automation server used by thousands of teams around the world. Whether you’re just starting with Jenkins, or looking to fine-tune your pipelines, this guide will help you understand what Jenkins is and how to get the most out of it!

Fine-Tuning Large Language Models for Stock Return Prediction Using Newsflow

Large language models (LLMs) and their fine-tuning techniques have demonstrated superior performance in various language understanding and generation tasks. This paper explores fine-tuning LLMs for stock return forecasting with financial newsflow. In quantitative investing, return forecasting is fundamental for subsequent tasks like stock picking, portfolio optimization, etc. We formulate the model to include text representation and forecasting modules. We propose to compare the encoder-only and decoder-only LLMs, considering they generate text representations in distinct ways. The impact of these different representations on forecasting performance remains an open question. Meanwhile, we compare two simple methods of integrating LLMs' token-level representations into the forecasting module. The experiments on real news and investment universes reveal that: (1) aggregated representations from LLMs' token-level embeddings generally produce return predictions that enhance the performance of long-only and long-short portfolios; (2) in the relatively large investment universe, the decoder LLMs-based prediction model leads to stronger portfolios, whereas in the small universes, there are no consistent winners. Among the three LLMs studied (DeBERTa, Mistral, Llama), Mistral performs more robustly across different universes; (3) return predictions derived from LLMs' text representations are a strong signal for portfolio construction, outperforming conventional sentiment scores.

How to market a game: an introduction to game marketing

Are you looking to market your game? This guide will teach you everything you need to know about game marketing, from targeting your audience to using unconventional tactics. You'll learn about the history of video game marketing, how social media and community management play a role, and more.

Automated Market Making and Decentralized Finance

Automated market makers (AMMs) are a new type of trading venues which are revolutionising the way market participants interact. At present, the majority of AMMs are constant function market makers (CFMMs) where a deterministic trading function determines how markets are cleared. Within CFMMs, we focus on constant product market makers (CPMMs) which implements the concentrated liquidity (CL) feature. In this thesis we formalise and study the trading mechanism of CPMMs with CL, and we develop liquidity provision and liquidity taking strategies. Our models are motivated and tested with market data.

Reinforcement Learning Pair Trading: A Dynamic Scaling approach

Cryptocurrency is a cryptography-based digital asset with extremely volatile prices. Around USD 70 billion worth of cryptocurrency is traded daily on exchanges. Trading cryptocurrency is difficult due to the inherent volatility of the crypto market. This study investigates whether Reinforcement Learning (RL) can enhance decision-making in cryptocurrency algorithmic trading compared to traditional methods. In order to address this question, we combined reinforcement learning with a statistical arbitrage trading technique, pair trading, which exploits the price difference between statistically correlated assets. We constructed RL environments and trained RL agents to determine when and how to trade pairs of cryptocurrencies. We developed new reward shaping and observation/action spaces for reinforcement learning. We performed experiments with the developed reinforcement learner on pairs of BTC-GBP and BTC-EUR data separated by 1 min intervals (n=263,520). The traditional non-RL pair trading technique achieved an annualized profit of 8.33%, while the proposed RL-based pair trading technique achieved annualized profits from 9.94% to 31.53%, depending upon the RL learner. Our results show that RL can significantly outperform manual and traditional pair trading techniques when applied to volatile markets such as~cryptocurrencies.