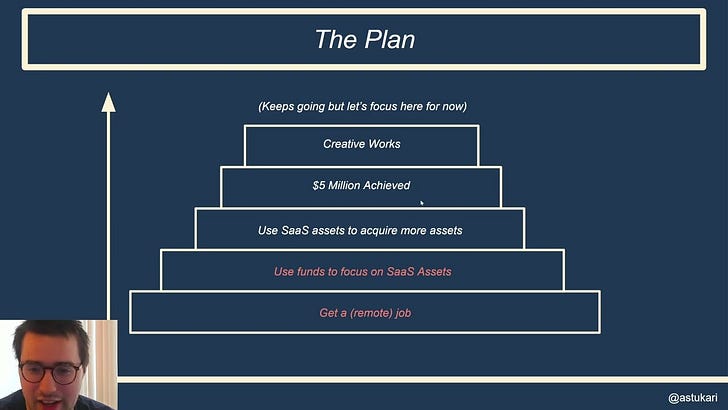

Making a new video every week until I make $5 million

Plus, more links to make you a little bit smarter today.

Making a new video every week until I make $5 million - Week 1

How to Build and Deploy with Databricks: Best Practices and More

Databricks has rapidly become a go-to platform for unified data analytics, combining the power of Apache Spark with collaborative features designed with scalable machine learning, ETL, and data exploration in mind. Whether you’re working in data or DevOps, understanding how to efficiently build and deploy on Databricks is key to maximizing its potential. In this article, we’ll explore best practices and tips for building robust solutions and deploying them effectively in Databricks environments!

Little Kitty, Big City: How a former Half-Life dev’s game for his kids became an overnight success

Double Dagger founder Matt Wood takes us through the development of his smash hit feline adventure

Creating Compelling and Continuous Gameplay in a Cozy Farming/Life Sim Adventure

'In the sea of games offering very similar types of experiences, creating emotionally meaningful connections go a long way in crafting a memorable experience.'

Liquidity Adjustment in Multivariate Volatility Modeling: Evidence from Portfolios of Cryptocurrencies and US Stocks

We develop a liquidity-sensitive multivariate volatility framework to improve the estimation of time-varying covariance structures under market frictions. We introduce two novel portfolio-level liquidity measures, liquidity jump and liquidity diffusion, which capture magnitude and volatility of liquidity fluctuation, respectively, and construct liquidity-adjusted return and volatility that reflect real-time liquidity variability. These liquidity-adjusted inputs are integrated into a VECM-DCC/ADCC-Bayesian model, allowing for conditional and posterior covariance estimation under liquidity stress. Applying this framework to portfolios of cryptocurrencies and US stocks, we find that traditional models misrepresent volatility and co-movement, while liquidity-adjusted models yield more stable and interpretable risk structures, particularly for portfolios of cryptocurrencies. The findings support the use of liquidity-adjusted multivariate models as statistically grounded tools for assessing the propagation of portfolio risk under market frictions, with implications for asset pricing, market microstructure design, and portfolio management.

Portfolio optimisation: bridging the gap between theory and practice

Portfolio optimisation is essential in quantitative investing, but its implementation faces several practical difficulties. One particular challenge is converting optimal portfolio weights into real-life trades in the presence of realistic features, such as transaction costs and integral lots. This is especially important in automated trading, where the entire process happens without human intervention.

Several works in literature have extended portfolio optimisation models to account for these features. In this paper, we highlight and illustrate difficulties faced when employing the existing literature in a practical setting, such as computational intractability, numerical imprecision and modelling trade-offs. We then propose a two-stage framework as an alternative approach to address this issue. Its goal is to optimise portfolio weights in the first stage and to generate realistic trades in the second. Through extensive computational experiments, we show that our approach not only mitigates the difficulties discussed above but also can be successfully employed in a realistic scenario.

By splitting the problem in two, we are able to incorporate new features without adding too much complexity to any single model. With this in mind we model two novel features that are critical to many investment strategies: first, we integrate two classes of assets, futures contracts and equities, into a single framework, with an example illustrating how this can help portfolio managers in enhancing investment strategies. Second, we account for borrowing costs in short positions, which have so far been neglected in literature but which significantly impact profits in long/short strategies. Even with these new features, our two-stage approach still effectively converts optimal portfolios into actionable trades.