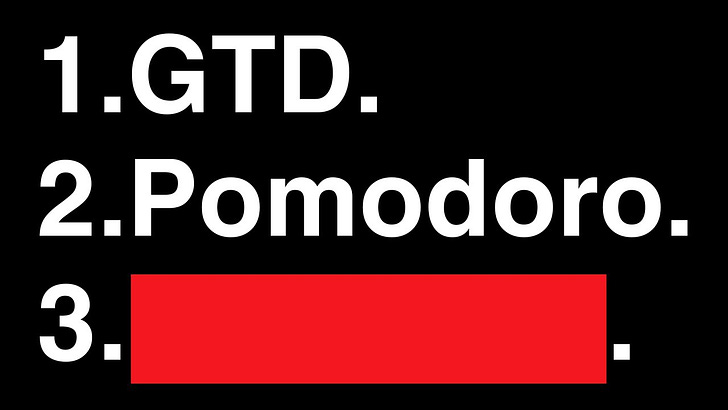

I Guarantee You've Never Heard Of This Productivity System

Plus, more links to make you a little bit smarter today.

I Guarantee You've Never Heard Of This Productivity System

You Are A Coward. And That’s Not So Bad, Really.

Chances are, you’ve been a coward at least once in your life. To be honest, you’ve probably been a coward most of your life. If you don’t believe me, read on.

Degree of Irrationality: Sentiment and Implied Volatility Surface

In this study, we constructed daily high-frequency sentiment data and used the VAR method to attempt to predict the next day’s implied volatility surface. We utilized 630,000 text data entries from East Money Stock Forum from 2014 to 2023, and employed deep learning methods such as BERT and LSTM to build daily market sentiment indicators. By applying FFT and EMD methods for sentiment decomposition, we found that high-frequency sentiment had a stronger correlation with at-the-money (ATM) options’ implied volatility, while low-frequency sentiment was more strongly correlated with deep out-of-the-money (DOTM) options’ implied volatility. Further analysis revealed that the shape of the implied volatility surface contains richer market sentiment information beyond just market panic. We demonstrated that incorporating this sentiment information can improve the accuracy of implied volatility surface predictions.

Automated Market Makers for Decentralized Finance (DeFi)

This paper compares mathematical models for automated market makers (AMM) including logarithmic market scoring rule (LMSR), liquidity sensitive LMSR (LS-LMSR), constant product/mean/sum, and others. It is shown that though LMSR may not be a good model for Decentralized Finance (DeFi) applications, LS-LMSR has several advantages over constant product/mean based AMMs. This paper proposes and analyzes constant ellipse based cost functions for AMMs. The proposed cost functions are computationally efficient (only requires multiplication and square root calculation) and have certain advantages over widely deployed constant product cost functions. For example, the proposed market makers are more robust against slippage based front running attacks. In addition to the theoretical advantages of constant ellipse based cost functions, our implementation shows that if the model is used as a cryptographic property swap tool over Ethereum blockchain, it saves up to 46.88% gas cost against Uniswap V2 and saves up to 184.29% gas cost against Uniswap V3 which has been launched in April 2021. The source codes related to this paper are available at https://github.com/coinswapapp and the prototype of the proposed AMM is available at https://yonggewang.github.io/ethcoinswap/.

Generative Artificial Intelligence: A Systematic Review and Applications

In recent years, the study of artificial intelligence (AI) has undergone a paradigm shift. This has been propelled by the groundbreaking capabilities of generative models both in supervised and unsupervised learning scenarios. Generative AI has shown state-of-the-art performance in solving perplexing real-world conundrums in fields such as image translation, medical diagnostics, textual imagery fusion, natural language processing, and beyond. This paper documents the systematic review and analysis of recent advancements and techniques in Generative AI with a detailed discussion of their applications including application-specific models. Indeed, the major impact that generative AI has made to date, has been in language generation with the development of large language models, in the field of image translation and several other interdisciplinary applications of generative AI. Moreover, the primary contribution of this paper lies in its coherent synthesis of the latest advancements in these areas, seamlessly weaving together contemporary breakthroughs in the field. Particularly, how it shares an exploration of the future trajectory for generative AI. In conclusion, the paper ends with a discussion of Responsible AI principles, and the necessary ethical considerations for the sustainability and growth of these generative models.

Price-Aware Automated Market Makers: Models Beyond Brownian Prices and Static Liquidity

In this paper, we introduce a suite of models for price-aware automated market making platforms willing to optimize their quotes. These models incorporate advanced price dynamics, including stochastic volatility, jumps, and microstructural price models based on Hawkes processes. Additionally, we address the variability in demand from liquidity takers through models that employ either Hawkes or Markovmodulated Poisson processes. Each model is analyzed with particular emphasis placed on the complexity of the numerical methods required to compute optimal quotes.

Preparing for Black Swans : The Antifragility Imperative for Machine Learning

Operating safely and reliably despite continual distribution shifts is vital for highstakes machine learning applications. This paper builds upon the transformative concept of “antifragility” introduced by (Taleb, 2014) as a constructive design paradigm to not just withstand but benefit from volatility. We formally define antifragility in the context of online decision making as dynamic regret’s strictly concave response to environmental variability, revealing limitations of current approaches focused on resisting rather than benefiting from nonstationarity. Our contribution lies in proposing potential computational pathways for engineering antifragility, grounding the concept in online learning theory and drawing connections to recent advancements in areas such as meta-learning, safe exploration, continual learning, multi-objective/quality-diversity optimization, and foundation models. By identifying promising mechanisms and future research directions, we aim to put antifragility on a rigorous theoretical foundation in machine learning. We further emphasize the need for clear guidelines, risk assessment frameworks, and interdisciplinary collaboration to ensure responsible application.