Hydrodynamics of Markets: Hidden Links Between Physics and Finance

Plus, more links to make you a little bit smarter today.

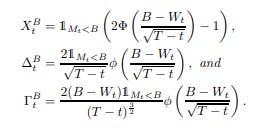

Gamma Hedging and Rough Paths

“We apply rough-path theory to study the discrete-time gamma-hedging strategy. We show that if a trader knows that the market price of a set of European options will be given by a diffusive pricing model, then the discrete-time gamma-hedging strategy will enable them to replicate other European options so long as the underlying pricing signal is sufficiently regular.”

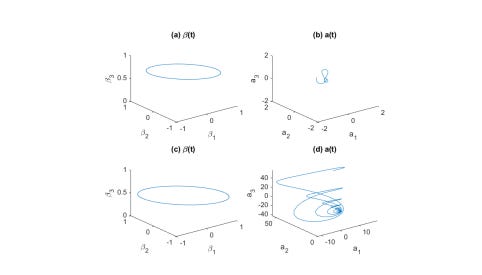

Hydrodynamics of Markets: Hidden Links Between Physics and Finance

“An intriguing link between a wide range of problems occurring in physics and financial engineering is presented. These problems include the evolution of small perturbations of linear flows in hydrodynamics, the movements of particles in random fields described by the Kolmogorov and Klein-Kramers equations, the Ornstein-Uhlenbeck and Feller processes, and their generalizations.”