Does AI help humans make better decisions?

“The use of Artificial Intelligence (AI) based on data-driven algorithms has become ubiquitous in today’s society. Yet, in many cases and especially when stakes are high, humans still make final decisions. The critical question, therefore, is whether AI helps humans make better decisions as compared to a human alone or AI alone. We introduce a new methodological framework that can be used to answer experimentally this question with no additional assumptions.

We measure a decision maker’s ability to make correct decisions using standard classification metrics based on the baseline potential outcome. We consider a single-blinded experimental design, in which the provision of AI-generated recommendations is randomized across cases with a human making final decisions.

Under this experimental design, we show how to compare the performance of three alternative decision-making systems — human-alone, human-with-AI, and AI-alone. We apply the proposed methodology to the data from our own randomized controlled trial of a pretrial risk assessment instrument. We find that AI recommendations do not improve the classification accuracy of a judge’s decision to impose cash bail. Our analysis also shows that AI-alone decisions generally perform worse than human decisions with or without AI assistance. Finally, AI recommendations tend to impose cash bail on non-white arrestees more often than necessary when compared to white arrestees”

How to Start Google

“Most of you probably think that when you're released into the so-called real world you'll eventually have to get some kind of job. That's not true, and today I'm going to talk about a trick you can use to avoid ever having to get a job.”

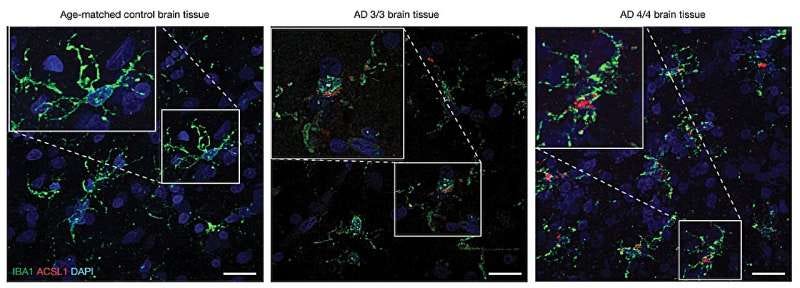

Root cause of Alzheimer's may be fat buildup in brain cells, research suggests

“A team of neurologists, stem cell specialists and molecular biologists affiliated with several institutions in the U.S. and led by a group at Stanford University School of Medicine has found evidence that the root cause of Alzheimer's disease may be fat buildup in brain cells. The study is published in the journal Nature.”

High-Throughput Asset Pricing

“We use empirical Bayes (EB) to mine data on 140,000 long-short strategies constructed from accounting ratios, past returns, and ticker symbols. This “high-throughput asset pricing” produces out-of-sample performance comparable to strategies in top finance journals. But unlike the published strategies, the data-mined strategies are free of look-ahead bias. EB predicts that high returns are concentrated in accounting strategies, small stocks, and pre-2004 samples, consistent with limited attention theories. The intuition is seen in the cross-sectional distribution of t-stats, which is far from the null for equal-weighted accounting strategies. High-throughput methods provide a rigorous, unbiased method for documenting asset pricing facts.”

Can a GPT4-Powered AI Agent Be a Good Enough Performance Attribution Analyst?

“Performance attribution analysis, defined as the process of explaining the drivers of the excess performance of an investment portfolio against a benchmark, stands as a significant feature of portfolio management and plays a crucial role in the investment decision-making process, particularly within the fund management industry. Rooted in a solid financial and mathematical framework, the importance and methodologies of this analytical technique are extensively documented across numerous academic research papers and books.

The integration of large language models (LLMs) and AI agents marks a groundbreaking development in this field. These agents are designed to automate and enhance the performance attribution analysis by accurately calculating and analyzing portfolio performances against benchmarks.

In this study, we introduce the application of an AI Agent for a variety of essential performance attribution tasks, including the analysis of performance drivers and utilizing LLMs as calculation engine for multi-level attribution analysis and question-answering (QA) tasks. Leveraging advanced prompt engineering techniques such as Chain-of-Thought (CoT) and Plan and Solve (PS), and employing a standard agent framework from LangChain, the research achieves promising results: it achieves accuracy rates exceeding 93% in analyzing performance drivers, attains 100% in multi-level attribution calculations, and surpasses 84% accuracy in QA exercises that simulate official examination standards. These findings affirm the impactful role of AI agents, prompt engineering and evaluation in advancing portfolio management processes, highlighting a significant development in the practical application and evaluation of Generative AI technologies within the domain.”