Cloudflare just flipped the script on Internet payments

Plus, more news to make you a little bit smarter today.

Anthropic just dropped Claude Sonnet 4.5—the AI that aims to ship production-grade apps, not just prototypes.

Claude Sonnet 4.5 is pitched as a frontier model delivering state-of-the-art coding performance and the ability to build “production-ready” applications. It will be accessible via the Claude API and the Claude chatbot, with pricing the same as Claude Sonnet 4 ($3 per million input tokens, $15 per million output tokens). Anthropic touts industry-leading benchmarks like SWE-Bench Verified, while acknowledging that real-world reliability matters more than numbers alone. Early demos describe autonomous coding for up to 30 hours, including setting up databases, purchasing domains, and even performing a SOC 2 audit. The release also introduces the Claude Agent SDK and a live-realtime research preview called “Imagine with Claude” for on-the-fly code generation. All of this unfolds in a competitive context where OpenAI’s GPT-5 is raising the bar, and Claude-driven tools power applications from Cursor, Windsurf, and Replit.

Taken together, the launch signals a shift toward end-to-end AI-assisted software delivery that must balance performance with governance, security, and trust. It won’t be enough to win on benchmarks alone; enterprises will demand strong alignment, robust prompt-injection defenses, and solid observability before shipping at scale. The rapid cadence of flagship models means leadership is fleeting, making ecosystems and real-world validation more valuable than ever. The fact that major players like Apple and Meta are reportedly using Claude internally underscores demand for enterprise-ready, auditable AI that can augment engineering—not replace it.

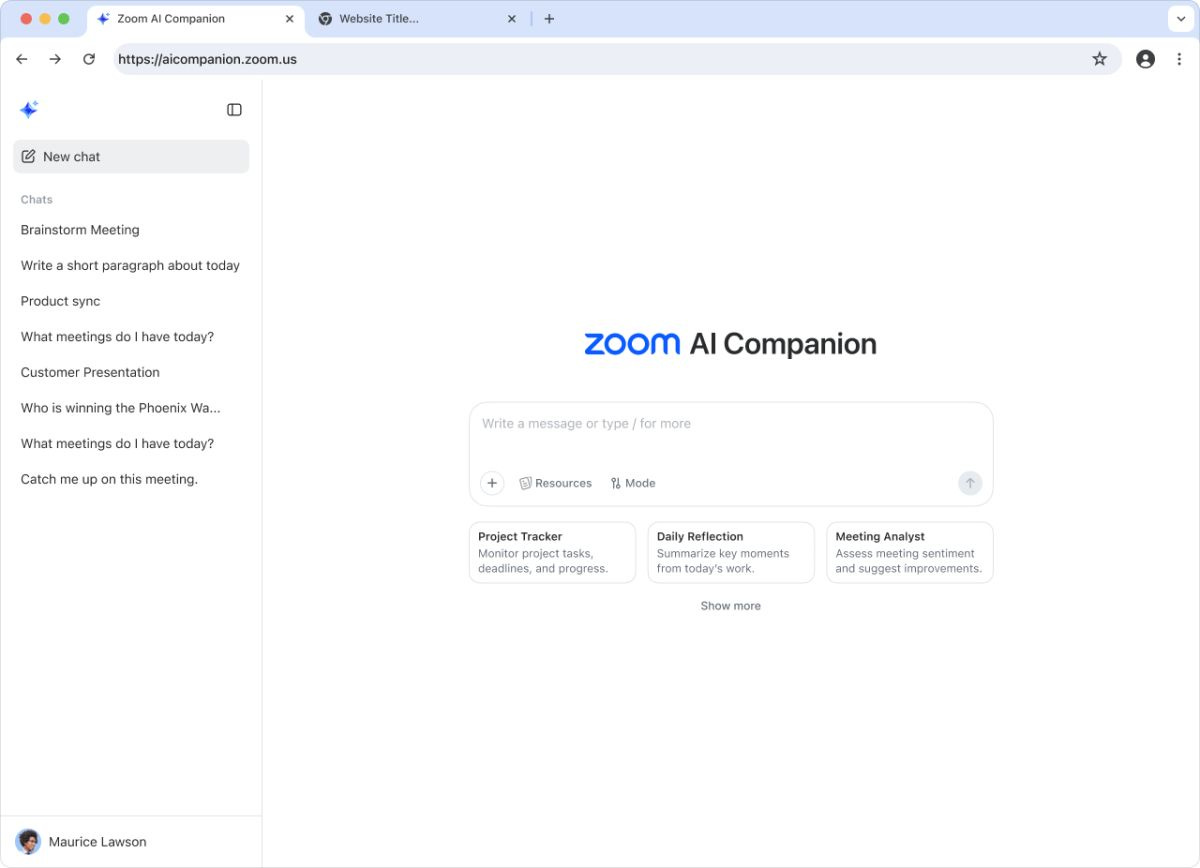

Zoom just unleashed an AI-powered meeting tool that could reshape how we work across platforms.

Zoom revealed at Zoomtopia an upgraded AI Companion that works across meeting apps (think Google Meet and Microsoft Teams), plus features to add your own notes, AI-powered scheduling, and photorealistic avatars. It’s also boosting cross-platform search, live translation, proactive meeting recommendations, and even a “free up my time” feature to trim unnecessary meetings. The goal: compete with cross-platform note tools and become the hub that tying together Google, Microsoft, and Zoom ecosystems. The update also includes new in-person note-taking, a revamped web interface, custom AI agents via MCP, higher video quality, and a Clips-based asynchronous video tool for hosts. It’s a bold move toward a more interoperable, AI-assisted meeting world—and it signals Zoom’s ambition to be the connective tissue of modern work.

What stands out is not just the feature set, but the direction: AI not as a siloed Zoom gimmick, but as a cross-platform assistant that can surface context from multiple ecosystems in real time. That raises important questions about data governance and privacy, but also opens exciting possibilities for productivity, onboarding, and collaboration in distributed teams. The risk of deepfake-style avatars and misuse is real, so responsible deployment and strong governance will be essential. If Zoom can balance openness with security, this could accelerate adoption of AI copilots across the enterprise and push competitors to raised bars in interoperability and workflow intelligence.

YC is rewriting the startup origin story: graduate first, then build.

This TechCrunch piece explains Y Combinator’s new Early Decision track, a formal path for students who want to start a company but finish college first. Applicants can apply in-school, get accepted and funded right away, and defer YC participation until after graduation. For example, a Fall 2025 applicant could graduate in Spring 2026 and join YC’s Summer 2026 batch. YC founder Jared Friedman notes it’s aimed at graduating seniors who want to launch a startup but also complete school. The move shifts the narrative away from “drop out to succeed” and toward a middle ground that broadens YC’s talent funnel, especially as college costs rise and more founders reassess the trade-offs of staying in school. The article highlights Spur’s Sneha Sivakumar and Anushka Nijhawan as a success story: they applied through Early Decision in 2023, graduated in 2024, joined Summer 2024, and have since raised $4.5M. It reflects YC’s broader effort to secure early-targeted talent in a competitive landscape, while acknowledging that many of the next decade’s top founders may choose both education and entrepreneurship.

This shift also invites deeper reflection: normalizing entrepreneurship alongside graduation could diversify founder profiles, reduce undue pressure to abandon school, and encourage more deliberate, user-driven product development. It signals a maturation in founder outcomes thinking, where long-term success isn’t tied to a single rite of passage but to meaningful traction, mentorship, and market fit—even if that means finishing a degree first.

Oracle’s $300B OpenAI pact could push debt to $100B to fund the cloud buildout.

This analysis explains KeyBanc Capital Markets’ projection that Oracle may need to raise about $25B in new debt each year for four years to support the datacenter expansion tied to the contract, all while remaining confronted by a ballooning backlog (RPO) reported at $455B. It also highlights Oracle’s balance-sheet context—roughly $10B in cash, significant long‑term debt, and rising capex that has driven free cash flow negative—along with Moody’s caution about counterparty risk given the OpenAI dependency.

Beyond the numbers, the piece offers a provocative commentary on how AI infrastructure is being financed: debt-backed scale around multi-year cloud commitments and large backlogs may be the new normal for rapid AI deployment. The risk is real if OpenAI’s profitability lags or if demand softens, leaving Oracle with heavy leverage and limited cushion. Equally important is the supply-chain dynamic—semiconductor capacity and hardware partners like Nvidia play a pivotal role in delivering the promised compute—and the question of whether lenders correctly price the risk in a highly speculative growth arc.

Cloudflare just flipped the script on Internet payments with the NET Dollar.

This article by Brian Fagioli reports that Cloudflare has launched NET Dollar, a USD-backed stablecoin designed to enable instant, cross-border payments for an AI-powered “agentic web.” The vision is for personal and business AI agents to act in real time—booking flights, paying for deliveries, and monetizing creator content—powered by a payments rail that moves money instantly and globally. Open standards like the Agent Payments Protocol and x402 are being contributed to simplify cross-network payments, while Cloudflare’s leadership frames this as a natural evolution from ad-based economics to pay-per-use and microtransactions that reward real value.

From a strategic perspective, this move signals a so-called rails play: a security and performance company expanding into the financial layer to become foundational infrastructure for the next Internet economy. If adopted, NET Dollar could unlock new monetization models for creators and developers but will depend on regulatory clarity, stability, and broad ecosystem uptake. The success hinges on network effects, interoperability, and the willingness of AI agents to transact automatically at the right moments—preserving trust, speed, and compliance at scale.